Automotive Air Filter Manufacturing Business

Phase 1: Vision Interrogation

Purpose Questions

1. What problem am I genuinely passionate about solving?

The automotive air filter business addresses the critical intersection of vehicular performance optimization, environmental compliance, and public health protection. With India facing severe air pollution challenges and vehicles contributing substantially to PM2.5 and PM10 emissions, high-quality air filtration becomes essential. This business solves the dual problem of ensuring engine longevity through clean air intake while simultaneously protecting cabin occupants from hazardous airborne pollutants—a problem affecting over 300 million vehicle users in India daily.

2. Is this a vitamin (nice-to-have) or painkiller (must-have) solution?

Painkiller solution. Automotive air filters are mandatory components for vehicle operation and regulatory compliance. BS-VI emission norms mandate advanced filtration systems, making them non-negotiable for OEM manufacturers and vehicle owners. Additionally, failure to replace filters leads to immediate, measurable consequences: reduced fuel efficiency (up to 10%), engine damage, increased emissions, and potential regulatory penalties. The recurring replacement cycle (every 15,000-20,000 km) creates sustained demand independent of economic conditions.

3. Can I articulate the vision in one sentence that excites stakeholders?

"Building India's most trusted domestic automotive air filter brand that combines BS-VI compliance excellence with affordability, serving the underserved aftermarket and emerging EV segments while creating sustainable employment in tier-2/tier-3 cities."

This vision appeals to multiple stakeholders: customers get quality at competitive prices, investors see scalable market opportunity with government backing, employees gain skill development, and regulators achieve compliance goals.

4. Will this matter in 10 years, or is it a fleeting trend?

This will matter significantly in 10 years. Multiple enduring factors ensure longevity: India's vehicle population is projected to exceed 500 million by 2035; air quality concerns will intensify, not diminish; regulatory standards will tighten further (potential BS-VII norms); and the EV revolution creates new filtration needs (cabin air quality, battery thermal management, electronics cooling). The fundamental physics of combustion engines and cabin air quality requirements guarantee sustained demand across technology transitions.

Market Reality Check

5. Who specifically will pay for this, and why should they care?

Primary payers:

- OEM manufacturers (Maruti Suzuki, Tata Motors, Mahindra, Hero MotoCorp): Require certified, cost-competitive filters for production lines; care about regulatory compliance, warranty costs, and supplier reliability.

- Aftermarket consumers: 25 million+ annual vehicle owners needing replacement filters; care about price, availability, engine protection, and fuel economy.

- Commercial fleet operators: Taxi companies, logistics firms, bus operators; care about total cost of ownership, vehicle uptime, and maintenance predictability.

- Auto parts distributors: Regional wholesalers seeking reliable suppliers with consistent quality; care about margins, inventory turnover, and brand reputation.

Why they care: Filter failure costs ₹5,000-₹50,000 in engine repairs, 10-15% fuel economy loss, regulatory non-compliance penalties, and vehicle downtime—all preventable with ₹300-₹800 filter investment.

6. What's the total addressable market, and how fast is it growing?

Total Addressable Market (TAM):

- India automotive air filter market: USD 179.77 million (2024) → USD 262.59 million (2033)

- CAGR: 4.30% (steady, recession-resistant growth)

- Unit volume: Estimated 60-70 million filters annually (considering 280+ million vehicles, 4-year replacement cycle)

Segment growth rates:

- Passenger cars: 6.5% CAGR

- Commercial vehicles: 5.8% CAGR

- Two-wheelers: 4.2% CAGR

- EV segment: 57.23% CAGR (small base, explosive growth)

Serviceable Available Market (SAM): Aftermarket segment represents approximately 45% of total market (~USD 81 million), growing faster than OEM segment due to aging vehicle population.

7. Which customer segment will champion this solution first?

Commercial vehicle fleet operators and aftermarket distributors in tier-2/tier-3 cities will champion this first. These segments are highly price-sensitive yet quality-conscious, underserved by premium brands, and accessible through regional distribution networks. Fleet operators influence thousands of replacement decisions annually and act as powerful reference customers. Success metrics: 20-30% lower cost than branded alternatives with equivalent or superior performance testing.

8. What's the switching cost for customers to adopt my solution?

Very low switching costs favor new entrants:

- Filters are standardized components with universal fitment specifications

- No specialized installation tools or training required

- Performance validation is immediate (fuel economy, engine smoothness)

- Low unit cost (₹300-₹800) minimizes trial risk

- No contractual lock-ins or compatibility issues

However, building trust requires: demonstrable quality certifications (ISO 9001, TS 16949), performance testing documentation, warranty offerings, and visible presence through distributor networks.

Phase 2: Market Intelligence & Validation

Primary Research Questions

9. Who are my ideal customers, and what keeps them awake at night?

Ideal Customer Profile 1: Commercial Fleet Owner

- Profile: Operates 20-500 vehicles (taxis, delivery vans, buses)

- Pain points: Unpredictable maintenance costs, vehicle downtime, driver productivity loss, fuel cost volatility, managing multiple suppliers

- Keeps them awake: Unexpected engine failures costing ₹30,000-₹100,000, vehicles sitting idle eating overhead, razor-thin profit margins (5-8%), driver complaints, regulatory inspection failures

Ideal Customer Profile 2: Auto Parts Distributor

- Profile: Regional wholesaler serving 50-200 mechanic shops

- Pain points: Inventory management, counterfeit product infiltration, margin pressure from online platforms, inconsistent supplier quality

- Keeps them awake: Capital tied up in slow-moving inventory, reputation damage from failed parts, competition from direct-to-consumer brands

Ideal Customer Profile 3: Informed Vehicle Owner

- Profile: Middle-class car/two-wheeler owner, 25-45 years old, urban/semi-urban

- Pain points: Information asymmetry at service centers, fear of being overcharged, uncertainty about part quality

- Keeps them awake: Rising maintenance costs, air pollution health concerns for children, being sold unnecessary services

10. What's their current solution, and why is it inadequate?

Current solutions:

- Branded OEM filters (MANN+HUMMEL, Bosch, Denso): High quality but 50-100% price premium; distribution limited to authorized dealers; overkill for cost-conscious segments.

- Unbranded local filters: 40-60% cheaper but inconsistent quality, poor filtration efficiency (70-80% vs. 99%+ required), shorter lifespan, no warranties, potential engine damage.

- Counterfeit filters: Visually similar to branded products but catastrophically poor performance; estimated 20-25% market share in aftermarket.

Inadequacy gaps:

- Quality-price paradox: No trusted middle-tier offering certified quality at 20-30% below premium pricing

- Distribution gaps: Rural and tier-3 markets underserved by premium brands

- Information asymmetry: Customers cannot verify filter performance without laboratory testing

- EV segment neglect: Few specialized cabin filters for EVs despite higher consumer expectations

11. How do they make buying decisions, and who influences them?

Decision-making process:

For Fleet Operators:

- Procurement manager evaluates based on: total cost of ownership calculations, supplier reliability track record, warranty terms, bulk pricing

- Influenced by: Maintenance supervisors (ease of use), drivers (vehicle performance feedback), accountants (budget adherence), industry peer recommendations

- Purchase cycle: Quarterly bulk orders with 30-60 day payment terms

For Individual Consumers:

- Triggered by: Dashboard warning lights, scheduled service intervals, mechanic recommendations, visible filter degradation

- Decision made at: Service center, based on mechanic recommendation (70%), price comparison (20%), brand familiarity (10%)

- Influenced by: Trusted mechanic (primary), online reviews (secondary), friend/family experience (tertiary)

For Distributors:

- Evaluate: Margin structure (30-40% expected), inventory turnover velocity, payment terms, return policies, brand marketing support

- Influenced by: Sales volume potential, competitor stocking decisions, manufacturer reputation

12. What's their willingness to pay, and what's their budget cycle?

Willingness to pay (WTP):

- Passenger car air filters: ₹300-₹800 (aftermarket), ₹600-₹1,200 (OEM branded)

- Commercial vehicle filters: ₹800-₹2,500 depending on vehicle class

- Two-wheeler filters: ₹150-₹400

- Premium cabin air filters: ₹800-₹1,500

Price sensitivity analysis:

- Fleet operators: Highly elastic demand; 15% price reduction drives 30-40% volume increase

- Individual consumers: Moderate elasticity; will pay 10-20% premium for trusted brand with warranty

- Distributors: Focus on absolute margin (₹100-₹200 per unit) rather than percentage

Budget cycles:

- Fleet operators: Annual maintenance budgets, quarterly procurement reviews

- Consumers: Irregular, triggered by service intervals (6-12 months)

- Distributors: Monthly inventory replenishment with seasonal peaks (pre-monsoon, festival seasons)

Competitive Landscape Analysis

13. Who are the direct and indirect competitors?

Direct Competitors (Established Filter Manufacturers):

Global Players:

- MANN+HUMMEL: Market leader, 20-25% India market share, strong OEM relationships, premium positioning

- Bosch: Diversified auto component giant, 15-18% filter market share, extensive distribution

- Denso: Japanese quality reputation, 10-12% share, focus on passenger cars

- Mahle: Premium segment, 8-10% share, strong in commercial vehicles

- Sogefi Group: Italian manufacturer, growing India presence

Domestic Players:

- Anand Filters: Largest Indian manufacturer, cost-competitive, strong aftermarket presence

- Fleetguard Filters (Cummins JV): Focus on heavy commercial vehicles, excellent distribution

- Rico Auto: Mid-tier positioning, regional strength

Indirect Competitors:

- Counterfeit/unbranded manufacturers: 20-25% market share, ultra-low pricing, quality concerns

- Imported Chinese filters: Growing e-commerce presence, 30-50% below branded pricing

- Integrated OEM supply: Captive filter production by vehicle manufacturers (reduces aftermarket opportunity)

14. What's their value proposition, and where do they fall short?

Competitor Value Propositions:

MANN+HUMMEL/Bosch:

- Proposition: "German engineering excellence, OEM-certified quality, global warranty"

- Shortfall: 80-100% price premium unaffordable for mass market; distribution limited to urban centers; perceived as "overengineered" for Indian conditions

Anand Filters:

- Proposition: "Trusted Indian brand, value pricing, wide availability"

- Shortfall: Quality perception below global brands; limited innovation in new segments (EV, HEPA cabin filters); basic marketing; inconsistent quality control in aftermarket channel

Unbranded Local:

- Proposition: "Lowest price, immediate availability at every corner shop"

- Shortfall: No quality assurance, potential engine damage, no warranty, filtration efficiency 40-60% below standards, frequent replacement needed

Market gaps our business can exploit:

- Quality-price sweet spot: BS-VI certified quality at 20-30% below premium brands

- Rural distribution: Penetration in tier-3/tier-4 markets underserved by major brands

- EV specialization: Cabin air quality filters for growing EV segment

- Transparent quality: QR-code based authenticity verification, published test results

- Flexible purchasing: Small-batch options for independent mechanics vs. bulk-only from majors

15. How do they price, distribute, and market their solutions?

Pricing Strategies:

- Premium brands: Cost-plus pricing with 60-80% gross margins; maintain price consistency to protect brand positioning; selective discounting only for OEM contracts

- Mid-tier brands: Market-based pricing 25-40% below premium; regional price variations based on competition; volume discounts for distributors (30-40% off MRP)

- Unbranded: Pure cost leadership, 50-70% below branded; no published pricing, negotiation-based

Distribution Models:

- OEM Channel: Direct contracts with vehicle manufacturers; stringent quality audits; 12-18 month payment cycles; 40-45% of market volume

- Aftermarket Channel: Three-tier distribution (manufacturer → C&F agents → distributors → retailers → consumers); 55-60% of market volume

- E-commerce: Emerging channel (5-8% currently); Amazon, Flipkart, auto parts marketplaces; higher margins but requires inventory investment and logistics management

- Direct-to-fleet: Large fleet operators serviced directly by manufacturers or through dedicated distributors

Marketing Approaches:

- Premium brands: Focus on OEM partnerships, technical publications, trade show presence, digital marketing to informed consumers; minimal retail advertising

- Domestic brands: Mechanic engagement programs, distributor incentives, local media advertising, vehicle service center partnerships; limited digital presence

- Market opportunity: Educational content marketing, quality demonstration videos, transparent testing data, mechanic training programs, QR-code product authentication

16. What's their funding, growth trajectory, and strategic vulnerabilities?

Competitor Financial Profiles:

MANN+HUMMEL India:

- Funding: Part of $5 billion global group; significant India manufacturing investment ($50-100 million expansion)

- Growth: 8-10% annual, aligned with premium vehicle segment growth

- Vulnerabilities: Premium pricing limits mass market penetration; slow adaptation to EV transition; high fixed costs vulnerable to volume fluctuations

Bosch India:

- Funding: Publicly listed (NSE: BOSCHLTD), strong balance sheet

- Growth: Diversified portfolio reduces filter segment focus; 6-8% filter growth

- Vulnerabilities: Filter business is minor revenue contributor (~3-5%); potential divestment or reduced focus; OEM contract dependency

Anand Filters:

- Funding: Privately held, estimated ₹200-400 crore annual revenue

- Growth: 10-12% annually, strong aftermarket momentum

- Vulnerabilities: Limited R&D for advanced filtration technologies; quality consistency issues in aftermarket; weak brand recall among end consumers; succession planning in family-owned business

Unbranded Sector:

- Funding: Fragmented, undercapitalized, informal financing

- Growth: Volume stable but market share declining due to quality awareness

- Vulnerabilities: Regulatory crackdown on substandard products; inability to meet BS-VI certification; no defense against organized competition

Strategic opportunities for new entrants: Premium brands' overpricing, domestic brands' quality gaps, unbranded sector's vulnerability to regulation, and EV segment neglect create multiple entry points.

Market Timing Assessment

17. Is the market ready for this solution now?

Yes, market timing is optimal. Multiple converging factors create a favorable entry window:

Demand-side readiness:

- BS-VI compliance mandatory since 2020; vehicle population now requires compliant replacement filters

- 280+ million vehicles on Indian roads; 60-70 million annual filter replacements needed

- Growing middle class (400+ million) with rising vehicle ownership and maintenance awareness

- Air pollution awareness at all-time high; consumers willing to invest in cabin air quality

Supply-side readiness:

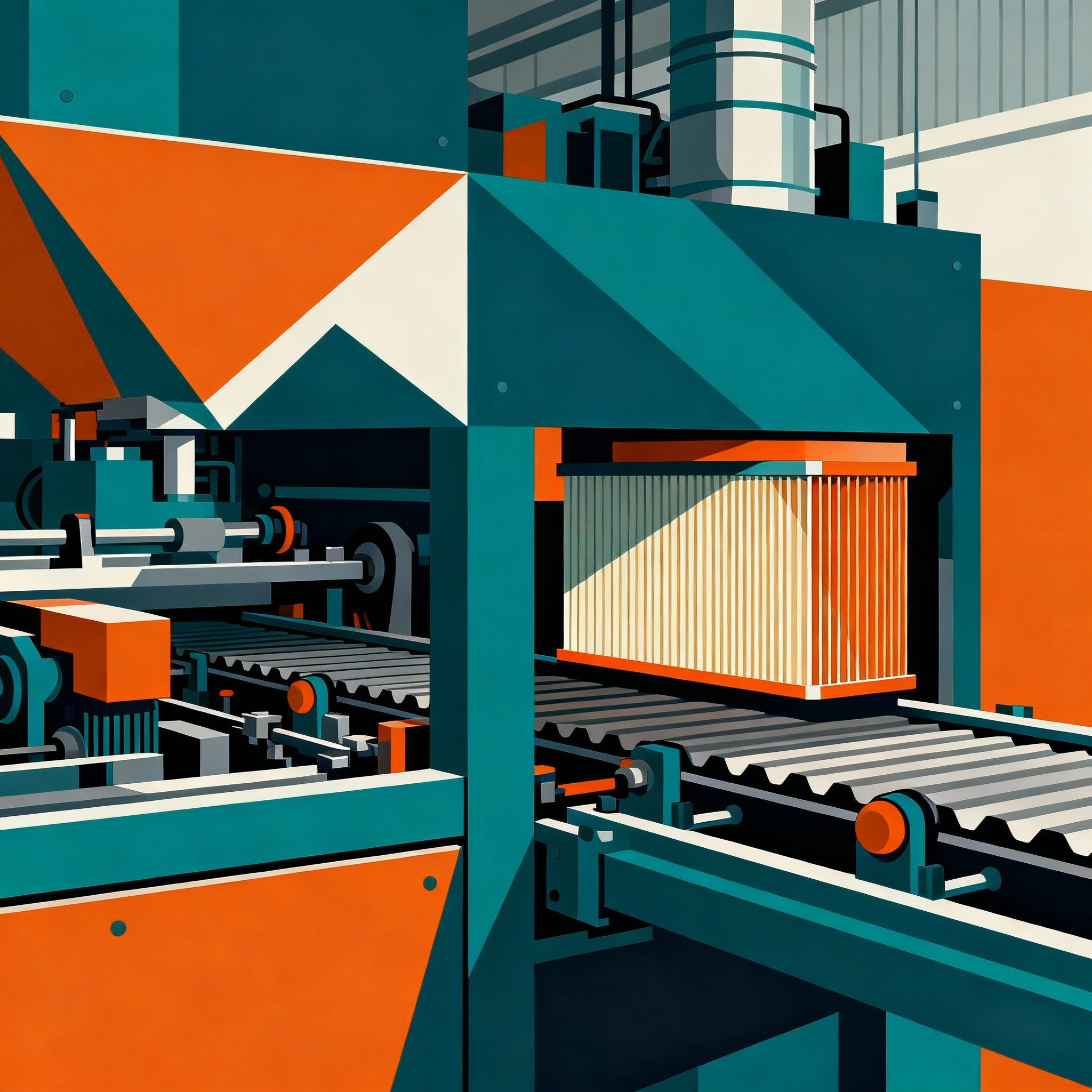

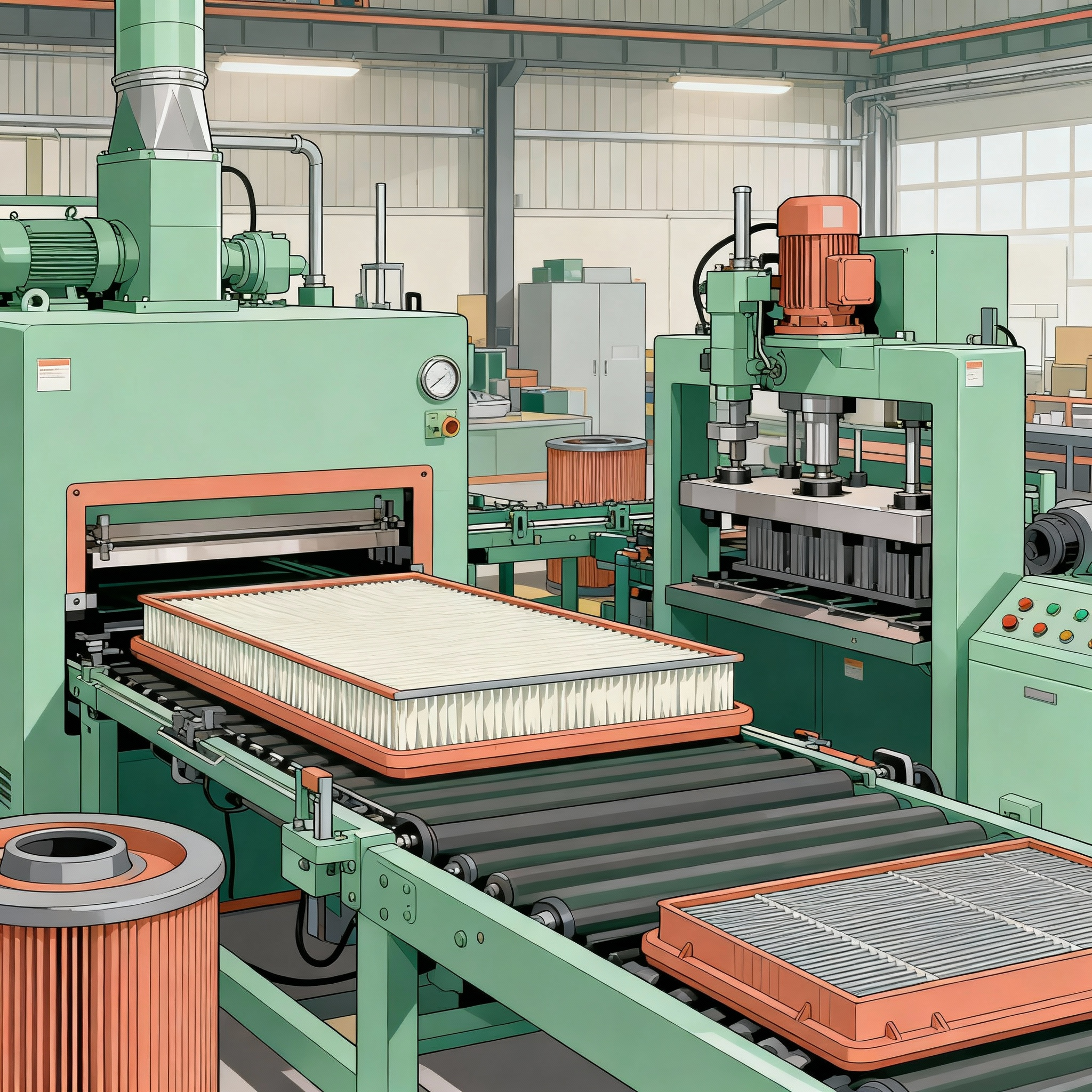

- Manufacturing equipment readily available from domestic suppliers (Kanwal Enterprises, Hi-Tech Machines)

- Raw material supply chains established; CRCA sheets, filter media, PU foam accessible

- Government subsidy programs (PMEGP) offering 35% capital subsidy and collateral-free loans

- Quality testing infrastructure available (NABL-accredited labs for ISO/TS certification)

Competitive landscape readiness:

- Premium brands focused on defending high margins rather than volume growth

- Domestic players lack innovation and aggressive expansion

- Counterfeit crackdown creating vacuum for legitimate mid-tier brands

18. What technology or regulatory changes are creating opportunities?

Regulatory Drivers:

BS-VI Emission Standards (Implemented April 2020):

- Mandate advanced air intake filtration with 99%+ efficiency for particulates >0.3 microns

- Create entry barrier against low-quality manufacturers lacking certification capability

- Require regular replacement (non-negotiable compliance), ensuring recurring revenue

Potential BS-VII Norms (Expected 2027-2030):

- May mandate HEPA-grade cabin filters, creating upgrade cycle opportunity

- Could introduce real-time filter condition monitoring, enabling predictive maintenance services

Central Motor Vehicle Rules (CMVR) Updates:

- Stricter roadworthiness testing including emission compliance; filters must meet standards or face penalties

GST Rationalization:

- Current 28% GST on auto parts; potential reduction to 18% would boost demand 8-12%

Technology Enablers:

Advanced Filter Media:

- Electrospun nanofiber technology improving filtration efficiency to 99.97% while reducing airflow restriction

- Activated carbon layers for VOC/odor removal in cabin filters (premium segment opportunity)

- Antimicrobial coatings addressing post-COVID health consciousness

Manufacturing Automation:

- CNC pleating machines reducing labor costs 40-50% while improving consistency

- Automated quality inspection systems (computer vision) ensuring 100% testing vs. sampling

- IoT-enabled production monitoring reducing downtime 20-30%

Digital Traceability:

- QR code/RFID tagging enabling anti-counterfeit verification and warranty management

- Blockchain-based supply chain transparency (future potential for export markets)

19. Are there economic or social trends accelerating demand?

Economic Trends:

Rising Disposable Income:

- Indian middle class projected to reach 600 million by 2030; vehicle ownership correlated with income growth

- Per capita income growing 6-7% annually (real terms); discretionary spending on vehicle maintenance increasing

Formalization of Economy:

- GST implementation driving shift from unorganized to organized manufacturing; benefits certified, compliant businesses

- Digital payment adoption making distributor transactions more transparent and accountable

Commercial Vehicle Electrification:

- FAME-II scheme incentivizing electric buses and commercial vehicles; new filter requirements for battery thermal management and cabin air quality

- Fleet operators prioritizing total cost of ownership; willing to pay premium for quality filters reducing maintenance

Social Trends:

Health Consciousness:

- Air pollution awareness driving demand for cabin air filters (growing 12-15% annually)

- Post-COVID emphasis on respiratory health; HEPA and antimicrobial filters gaining traction

- Urban consumers researching product quality; reduced reliance on mechanic recommendations alone

Sustainability Focus:

- Growing preference for longer-lasting, recyclable filter materials

- Corporate fleet buyers incorporating ESG criteria; sustainable suppliers preferred

Urbanization:

- 600+ million urban population by 2030; concentrated vehicle density increases replacement frequency due to higher pollution exposure

Information Democratization:

- YouTube mechanic tutorials, automotive forums, WhatsApp groups empowering consumers to challenge poor service; demand for transparent quality information

20. What's the optimal entry timing versus competitive response?

Optimal Entry Timeline: Q1-Q2 2026 (12-18 months from now)

Phase 1 (Current - 6 months): Foundation Building

- Secure PMEGP loan approval and subsidy (3-4 months process)

- Finalize equipment procurement and facility setup (6 months)

- Develop supplier relationships for raw materials

- Initiate ISO 9001 and TS 16949 certification processes (6-9 months)

- Conduct product development and testing for 5-8 SKUs covering 70% of market

Phase 2 (6-12 months): Soft Launch

- Begin production at 30-40% capacity targeting aftermarket distributors in 2-3 regional markets

- Build reference customer base (20-30 fleet operators, 50-100 mechanic shops)

- Collect performance feedback and iterate on product/packaging

- Establish quality track record for 6-12 months before aggressive scaling

Phase 3 (12-18 months): Market Expansion

- Scale to 60-70% capacity with proven product-market fit

- Expand distribution to 8-10 states

- Launch brand marketing and mechanic engagement programs

- Pursue OEM trial contracts with tier-2 vehicle manufacturers

Competitive Response Timeline:

- Premium brands: Unlikely to react to tier-2 entrant for 18-24 months; their business model cannot accommodate price matching

- Domestic incumbents: May respond with localized price cuts (10-15%) in contested markets; limited threat if we differentiate on quality and service

- New entrants: Expect 2-3 copycat competitors within 24 months; first-mover advantage in distribution relationships and brand building is critical

Entry window rationale: Current period offers 18-24 month runway before market becomes crowded; BS-VI vehicle population reaching critical mass for aftermarket replacement; PMEGP subsidy still available; equipment suppliers have capacity.

Phase 3: Strategic Architecture

Revenue Model Questions

21. How will we monetize value creation?

Primary Revenue Streams:

Stream 1: Aftermarket Filter Sales (60-65% of revenue)

- Direct sales to distributors at 30-40% discount to MRP

- Gross margin: 45-50% at manufacturer level

- Payment terms: 30-60 days credit for established distributors

- Volume-based incentives: Additional 5-10% for quarterly targets

Stream 2: OEM Contracts (20-25% of revenue)

- Annual/multi-year supply agreements with tier-2/tier-3 vehicle manufacturers

- Gross margin: 25-30% (lower margin, higher volume, predictable cash flow)

- Payment terms: 90-120 days (industry standard)

- Requires quality certifications and production capacity guarantees

Stream 3: Direct-to-Fleet Sales (10-15% of revenue)

- Bulk supply contracts with commercial fleet operators (50+ vehicles)

- Gross margin: 35-40% (bypassing distributor layer)

- Payment terms: 45-60 days

- Annual maintenance contracts providing recurring revenue visibility

Stream 4: E-commerce/D2C (5-8% of revenue, growing)

- Direct sales through Amazon, Flipkart, company website

- Gross margin: 40-45% (after marketplace commissions 15-20%)

- Payment realization: 7-15 days

- Higher customer acquisition cost but builds brand equity

Ancillary Revenue Opportunities (Future):

- Extended warranty programs (₹50-₹100 per filter, 30-40% margin)

- Filter subscription service for fleet operators (predictable maintenance)

- Licensing manufacturing process to regional partners (royalty-based)

- Export markets (Africa, Southeast Asia) once domestic scale achieved

22. Is this transactional, subscription, or platform-based revenue?

Hybrid Model with Transactional Core:

Primary Model: Transactional (80-85% of revenue)

- One-time filter purchases driven by replacement cycles

- Advantages: Low customer acquisition friction, matches existing market behavior, simple revenue recognition

- Challenge: Requires continuous demand generation; vulnerable to competitive promotions

Secondary Model: Subscription-Adjacent (10-15% of revenue)

- Fleet maintenance contracts: Quarterly filter supply + installation services

- Structured as annual contracts with quarterly invoicing

- Advantages: Revenue predictability, customer retention, higher lifetime value

- Implementation: Requires field service capability or partnership with service networks

Future Potential: Platform Model (5-10% revenue by Year 5)

- Digital marketplace connecting filter manufacturers, distributors, mechanics, and consumers

- Revenue from: Transaction fees (2-3%), advertising, data analytics services to OEMs

- Advantages: Scalable with minimal inventory, network effects, high margins

- Prerequisites: Scale, technology investment, market aggregation

Recommendation: Start transactional, build subscription revenue through fleet contracts by Year 2, explore platform opportunities by Year 4-5 after establishing market credibility.

23. What's the customer lifetime value versus acquisition cost?

Customer Lifetime Value (CLV) Analysis:

For Distributors (Primary Customer):

- Average order value: ₹50,000-₹100,000 per month

- Gross profit per distributor: ₹15,000-₹30,000/month (30-40% distributor margin on our wholesale price)

- Average relationship duration: 5-7 years (if well-serviced)

- CLV: ₹9,00,000 - ₹25,00,000 over lifetime (discounted at 15%)

- Retention rate: 80-85% annually (high switching costs once integrated)

For Fleet Operators (Direct B2B):

- Average fleet size: 50-200 vehicles

- Filter requirement: 50-200 units annually (₹20,000-₹80,000 revenue)

- Gross profit: ₹7,000-₹28,000 annually (35-40% margin)

- Average relationship duration: 6-8 years

- CLV: ₹2,50,000 - ₹12,00,000 over lifetime

For Individual Consumers (D2C):

- Purchase frequency: Every 1-2 years

- Average order value: ₹500-₹1,000

- Gross profit per purchase: ₹200-₹400 (40-45% margin)

- Lifetime: 8-10 years (vehicle ownership period)

- CLV: ₹1,000 - ₹2,500 (low individual value, scale through volume)

Customer Acquisition Cost (CAC) Analysis:

For Distributors:

- Sales team salary/commission: ₹10,000-₹15,000 per acquisition

- Sample products and initial promotion support: ₹5,000-₹10,000

- Credit risk assessment and initial credit period: ₹5,000

- CAC: ₹20,000 - ₹30,000

- CLV/CAC Ratio: 30:1 to 83:1 (excellent economics)

For Fleet Operators:

- Sales effort (meetings, presentations, trials): ₹15,000-₹25,000

- Product samples and testing: ₹5,000-₹10,000

- Contract negotiation and setup: ₹5,000

- CAC: ₹25,000 - ₹40,000

- CLV/CAC Ratio: 6:1 to 30:1 (very good economics)

For Individual Consumers (D2C):

- Digital marketing (Facebook/Google ads): ₹150-₹300 per acquisition

- Marketplace commissions (already included in margin)

- Content marketing (amortized): ₹50-₹100 per acquisition

- CAC: ₹200 - ₹400

- CLV/CAC Ratio: 2.5:1 to 12.5:1 (acceptable for brand building, but requires scale)

Strategic Implication: Prioritize distributor and fleet acquisition in Years 1-3 (superior unit economics), build D2C channel gradually for brand equity and market intelligence.

24. How do unit economics scale with volume?

Unit Economics Progression (Per Filter Basis):

Year 1 (40% Capacity, 60,000 units annually):

- Average selling price: ₹500 (wholesale to distributors)

- Raw material cost: ₹200 (40%)

- Labor cost: ₹80 (16%)

- Overhead allocation: ₹120 (24%)

- Gross margin: ₹100 (20%)

- Net margin: ₹40 (8%) after fixed costs

Year 3 (60% Capacity, 90,000 units annually):

- Average selling price: ₹520 (2% annual price increase)

- Raw material cost: ₹190 (37%, 5% volume discount from suppliers)

- Labor cost: ₹60 (12%, efficiency gains)

- Overhead allocation: ₹85 (16%, fixed costs spread over more units)

- Gross margin: ₹185 (36%)

- Net margin: ₹80 (15%) after fixed costs

Year 5 (75% Capacity, 112,500 units annually):

- Average selling price: ₹540 (product mix shift toward higher-margin cabin filters)

- Raw material cost: ₹185 (34%, further volume discounts and alternate sourcing)

- Labor cost: ₹50 (9%, semi-automation of assembly)

- Overhead allocation: ₹75 (14%, optimal capacity utilization)

- Gross margin: ₹230 (43%)

- Net margin: ₹110 (20%) after fixed costs

Economies of Scale Mechanisms:

Purchasing Power:

- 20-30% raw material cost reduction through volume discounts (CRCA sheets, filter media)

- Ability to negotiate annual contracts vs. spot purchases

Labor Efficiency:

- Learning curve effects: 15-20% productivity improvement by Year 3

- Semi-automation investment justifiable at 60%+ capacity (₹8-12 lakh investment)

Fixed Cost Leverage:

- Rent, utilities, supervision spread over 80% more units from Year 1 to Year 5

- Quality testing equipment (₹2-3 lakhs investment) cost per unit drops 75%

Marketing Efficiency:

- Brand equity reduces customer acquisition cost 30-40% by Year 3

- Distributor network self-expands through word-of-mouth

Break-even Analysis:

- Fixed costs: ₹22 lakhs annually (rent, salaries, utilities, depreciation)

- Contribution margin: ₹300 per unit (average)

- Break-even volume: 73,333 units annually (29% of 250,000 unit installed capacity)

- Achieved in Month 8-10 of Year 1 based on 40% capacity utilization

Value Chain Analysis

25. What activities will we perform in-house versus outsource?

In-House Activities (Core Competencies):

Manufacturing & Assembly (Must Own):

- Sheet metal stamping and canister fabrication (maintains quality control, protects IP)

- Filter pleating and media assembly (differentiates product quality)

- Final assembly and quality inspection (ensures consistency, reduces liability)

- Rationale: These activities determine product quality and are difficult to control if outsourced

Quality Assurance & Testing (Must Own):

- In-process quality checks (visual, dimensional, filtration efficiency sampling)

- Final product testing (pressure drop, dust holding capacity)

- Rationale: Quality is primary competitive differentiator; cannot delegate to third parties

Product Development (Must Own):

- New filter design for emerging vehicle models

- Material experimentation and supplier qualification

- Rationale: Innovation drives differentiation; outsourcing eliminates competitive advantage

Distributor Relationship Management (Must Own):

- Key account management for top 20-30 distributors (generating 70-80% of revenue)

- Rationale: Relationships are strategic assets; cannot be intermediated

Outsourced Activities (Non-Core):

Raw Material Production (Outsource):

- CRCA sheet manufacturing (commodity, capital-intensive, available from Tata Steel, JSW, local traders)

- Filter media production (specialized, economies of scale require dedicated facilities)

- PU foam, adhesives, fasteners (standardized components)

- Rationale: No differentiation, suppliers offer better economics and quality

Component Casting/Machining (Outsource):

- Aluminum/zinc/plastic top and bottom caps (job shops offer 20-30% cost advantage)

- Wire mesh fabrication (standardized process, numerous suppliers)

- Rationale: Capital-intensive, fluctuating demand, local job shops provide flexibility

Logistics & Warehousing (Outsource):

- Transportation to distributors (third-party logistics providers offer 30-40% cost savings vs. owned fleet)

- Regional warehousing (C&F agents manage inventory and local distribution)

- Rationale: Non-core, requires geographic spread and working capital

Accounting & Compliance (Outsource):

- GST filing, payroll processing, statutory audits (professional firms offer expertise and liability management)

- Rationale: Specialized knowledge, regulatory risk mitigation

Digital Marketing (Hybrid):

- Content strategy and brand positioning (in-house for authentic voice)

- Campaign execution (Facebook ads, Google ads, SEO) (outsource to specialized agencies)

- Rationale: Strategy is core; execution benefits from specialist tools and expertise

Make-Buy Decision Framework:

- Strategic importance: High → In-house

- Capital intensity: High → Outsource (unless strategic)

- Supplier market competitiveness: High → Outsource

- Quality criticality: High → In-house

- Economies of scale: Require >2x our volume → Outsource

26. Where can we create defensible competitive advantages?

Sustainable Competitive Advantages (Moats):

Moat 1: Quality Certification & Track Record

- Acquire ISO 9001, TS 16949, ISO/TS 16949 certifications within 12 months (₹3-5 lakh investment)

- Publish third-party laboratory test results (filtration efficiency, dust holding capacity, pressure drop) transparently

- Build 18-24 month defect-free track record with reference customers

- Defensibility: Takes competitors 18-24 months to replicate; creates trust barrier

Moat 2: Distributor Relationship Network

- Sign exclusive/semi-exclusive agreements with 100-150 distributors across 8-10 states by Year 3

- Provide superior service (24-hour query response, 7-day replacement for defects, quarterly business reviews)

- Co-invest in distributor capability building (inventory management software, sales training)

- Defensibility: High switching costs for distributors once integrated; competitors must offer 20-30% better terms to poach

Moat 3: Brand Equity with Mechanics

- Train 500-1,000 mechanics on filter quality assessment, proper installation, troubleshooting

- Provide "Certified Installer" program with branded materials and referral incentives

- Offer mechanic-exclusive hotline for technical support

- Defensibility: Mechanics influence 70-80% of consumer filter purchases; brand loyalty difficult to displace

Moat 4: Process Innovation & Cost Efficiency

- Develop semi-automated pleating process reducing labor cost 30-40% (₹8-12 lakh investment by Year 3)

- Implement lean manufacturing reducing waste 15-20%

- Optimize raw material mix (e.g., blended filter media) maintaining performance at 10-15% lower cost

- Defensibility: Process knowledge embedded in workforce and equipment; competitors cannot reverse-engineer

Moat 5: Data & Customer Intelligence

- Build database of filter failure patterns by vehicle model, geography, usage pattern (10,000+ data points by Year 3)

- Use insights to optimize product design and predict demand

- Offer predictive maintenance services to fleet customers based on data analytics

- Defensibility: Data accumulates over time; competitors starting later face permanent information disadvantage

Moats NOT Pursued (Rationale):

- Patent protection: Filter designs difficult to patent; reverse-engineering easy; enforcement costly

- Backward integration into raw materials: Capital-intensive, diverts focus, suppliers offer better economics

- Exclusive distribution: Creates conflict and limits market access; prefer open distribution with loyalty incentives

27. What partnerships are essential for success?

Critical Partnership Categories:

Category 1: Raw Material Suppliers (Strategic)

Filter Media Suppliers:

- Target Partners: Ahlstrom-Munksjö, Johns Manville, Hollingsworth & Vose (global), or domestic producers like Praj Industries

- Partnership Terms: Annual volume commitments for 10-15% price discount; 60-90 day payment terms; joint product development for new media

- Value Exchange: We provide volume and growth; they provide quality consistency and technical support

- Criticality: Filter media represents 25-30% of COGS and directly impacts product performance

Steel Sheet Suppliers:

- Target Partners: Tata Steel, JSW Steel regional distributors, or local metal traders

- Partnership Terms: Quarterly contracts with volume-based pricing; just-in-time delivery to minimize working capital

- Value Exchange: We provide predictable volume; they provide credit terms and delivery reliability

- Criticality: CRCA sheets represent 20-25% of COGS; price volatility risk requires hedging through contracts

Category 2: Distributor Network (Essential)

Regional C&F Agents:

- Target Partners: Established auto parts distributors with 500-1,000 mechanic shop relationships in each region

- Partnership Terms: Semi-exclusive arrangement (can carry competing brands but must give us shelf priority); 30-40% trade margin; quarterly incentives for volume targets; we fund initial inventory

- Value Exchange: We provide branded, certified product with marketing support; they provide market access and working capital absorption

- Criticality: Distribution is the primary market access barrier; 80-85% of aftermarket sales flow through distributors

Category 3: Technology & Equipment Vendors (Enabling)

Machinery Suppliers:

- Target Partners: Kanwal Enterprises (filter assembly equipment), Hi-Tech Machines (power presses), Siddhapura (metal working equipment)

- Partnership Terms: Equipment purchase with 12-24 month warranty; annual maintenance contracts; training for operators; spare parts availability

- Value Exchange: We provide business and referrals; they provide installation, training, and after-sales support

- Criticality: Equipment uptime directly impacts production; downtime costs ₹20,000-₹30,000 per day

Quality Testing Partners:

- Target Partners: NABL-accredited testing laboratories (for initial certification), eventually in-house testing equipment from suppliers like Kanwal Enterprises

- Partnership Terms: Per-sample testing fees (₹3,000-₹5,000 per test); discounted rates for volume; fast turnaround (5-7 days)

- Value Exchange: We provide volume; they provide credible third-party validation

- Criticality: Certification is prerequisite for OEM contracts and premium aftermarket positioning

Category 4: Financial Partners (Critical for Scaling)

PMEGP Implementing Agency (KVIC/Banks):

- Target Partners: State-level KVIC offices, scheduled commercial banks (SBI, Bank of Baroda, Punjab National Bank)

- Partnership Terms: 35% subsidy on project cost (rural area); 90% debt funding at 8-10% interest; moratorium period 6-12 months

- Value Exchange: We create employment (8-10 persons) and comply with reporting; they fulfill scheme mandates

- Criticality: Reduces capital requirement from ₹21.78 lakhs to ₹2.18 lakhs (90% reduction in founder capital)

Category 5: Market Development Partners (Growth Accelerators)

OEM Relationships (Tier-2 Vehicle Manufacturers):

- Target Partners: Force Motors, SML Isuzu, Mahindra (for commercial vehicles); Hero Electric, Ather (for EVs)

- Partnership Terms: Annual supply contracts for 10,000-50,000 units; stringent quality audits; 90-120 day payment terms; long-term pricing agreements

- Value Exchange: We provide cost savings (20-30% below premium brands) with quality; they provide volume and credibility

- Criticality: OEM supply provides revenue stability, brand credibility, and capacity utilization (25-30% of revenue target)

Fleet Management Companies:

- Target Partners: Regional taxi aggregators, logistics companies (Delhivery, Ecom Express local franchises), school bus operators

- Partnership Terms: Annual maintenance contracts; bulk pricing (30-35% margin); payment terms 45-60 days; performance guarantees

- Value Exchange: We provide total cost savings through quality; they provide recurring revenue and case studies

- Criticality: Fleet customers offer highest lifetime value and serve as reference accounts for aftermarket

28. How do we build switching costs and network effects?

Switching Cost Mechanisms:

For Distributors (Primary Focus):

Financial Switching Costs:

- Credit line integration: Offer 30-60 day credit terms; distributors must re-establish creditworthiness with new supplier (3-6 months process)

- Inventory optimization: Co-invest in inventory management system that tracks stock levels, predicts demand; switching requires new system learning curve

- Volume incentive structures: Quarterly performance bonuses (5-10% additional margin) require starting from zero with new supplier

Operational Switching Costs:

- Custom packaging and labeling: Develop distributor-specific SKUs for major partners; switching means re-educating retail network on new packaging

- Logistics integration: Integrate with distributor's ordering system (WhatsApp Business API, ERP connectivity); switching requires new system setup

- Return/warranty handling: Streamlined process for defect returns (24-48 hour replacement); new suppliers have untested processes creating operational risk

Relational Switching Costs:

- Dedicated account managers: Quarterly business reviews, market intelligence sharing, co-marketing; relationship takes 12-18 months to replicate

- Mechanic training programs: Co-branded installer certification; switching requires re-training mechanics on new product line

- Estimated total switching cost: ₹50,000-₹150,000 per distributor (combination of tangible and opportunity costs)

For Fleet Operators:

Performance History:

- Build 12-24 month defect-free supply record; new supplier represents untested risk to fleet uptime

- Document fuel economy improvements (5-8% demonstrated savings); switching requires re-baselining

- Estimated switching cost: ₹30,000-₹80,000 in risk and re-qualification effort

For Individual Consumers (Lower Switching Costs):

Brand Familiarity:

- QR code-based authenticity verification and product history; consumers trust known authentication systems

- Loyalty programs: "Buy 3 get 1 free" type promotions requiring repeat purchases

- Estimated switching cost: ₹200-₹500 in forgone loyalty benefits and re-evaluation effort

Network Effects (Building Multi-Sided Platform):

Phase 1 (Year 1-2): Linear Value Creation

- Current state: No network effects; value to each customer independent of other customers

- Example: Distributor A's value from partnership not influenced by Distributor B's participation

Phase 2 (Year 3-4): Same-Side Network Effects

- Distributor Network Effects: As more distributors join, brand visibility increases; each distributor benefits from others' marketing efforts (co-op advertising, word-of-mouth)

- Mechanic Network Effects: As more mechanics get trained and recommend product, brand credibility increases; easier for new mechanics to trust and adopt

- Measurement: Each new distributor increases overall market awareness 0.1-0.2%, reducing acquisition cost for subsequent distributors

Phase 3 (Year 5+): Cross-Side Network Effects (Platform Model)

- Demand-Side (Distributors/Mechanics): Attract more distributors/mechanics → increases visibility to consumers → drives more consumer demand

- Supply-Side (Manufacturers/Suppliers): More consumer demand → justifies broader product range → attracts more suppliers willing to partner

- Data Network Effects: More users → more performance data → better predictive maintenance algorithms → higher value to all users

- Platform Revenue: Transaction fees on marketplace connecting manufacturers, distributors, mechanics, consumers; advertising revenue from OEMs seeking market intelligence

Implementation Roadmap:

- Years 1-2: Build switching costs aggressively (focus on distributor/fleet integration and service excellence)

- Years 3-4: Activate same-side network effects (mechanic community building, co-marketing)

- Years 5+: Explore platform model if scale justifies (requires 500+ distributors, 5,000+ mechanics, 50,000+ consumers)

Technology & Innovation Strategy

29. What technology capabilities are table stakes versus differentiators?

Table Stakes (Must-Have for Market Entry):

Manufacturing Technologies:

- Power press operations: 5-10 ton capacity for sheet metal stamping; industry standard for filter canister production

- Pleating machines: Manual or semi-automated for filter media folding; every manufacturer has this capability

- Spot welding equipment: For canister assembly; basic technology, widely available

- Quality testing equipment: Pressure drop testing, visual inspection; required for BS-VI certification

- Rationale: Absence of any of these prevents market entry; presence provides no competitive advantage

Quality Certifications:

- ISO 9001: Quality management system; baseline requirement for B2B sales

- BS-VI compliance: Mandatory for legal sale; all competitors certified

- Rationale: Necessary but not sufficient; customers assume you have these

Basic Digital Presence:

- Company website: Product catalog, contact information; expected by all B2B buyers

- WhatsApp Business: Communication with distributors/mechanics; standard in Indian B2B

- Rationale: Absence signals unprofessionalism; presence is neutral

Differentiators (Competitive Advantages):

Advanced Manufacturing:

- Automated pleating with CNC control: 30-40% labor cost reduction, +15-20% consistency improvement; only 20-30% of mid-tier manufacturers have this

- In-line quality inspection (computer vision): 100% testing vs. sampling; premium brands have this, most mid-tier don't

- Rapid changeover capabilities: <30 minutes to switch between filter models vs. 2-4 hours industry average; enables small-batch economics

- Rationale: Creates cost and quality advantages that distributors and OEMs value; difficult to replicate without ₹15-25 lakh investment

Product Innovation:

- Multi-layer filtration media: Combines coarse pre-filter + fine HEPA + activated carbon for superior performance; premium positioning

- Antimicrobial coatings: Post-COVID health appeal, especially for cabin filters; few domestic brands offer

- EV-specific designs: Optimized for electric vehicle cabin air quality and battery thermal management; underserved segment

- Rationale: Commands 15-25% price premium, attracts early adopters, creates brand differentiation

Digital Differentiation:

- QR-based product authentication: Combats counterfeiting, builds trust; few mid-tier brands implement

- Filter lifespan tracking app: Consumers scan QR code, get replacement reminders based on mileage/time; unique value-add

- Predictive maintenance platform for fleets: Uses filter data + vehicle telematics to optimize replacement scheduling; B2B SaaS revenue opportunity

- Rationale: Low implementation cost (₹2-5 lakhs), high perceived value, creates data moat

Supply Chain Technology:

- Distributor portal with real-time inventory visibility: Reduces stockouts, improves working capital efficiency; uncommon in mid-tier

- Automated demand forecasting: Uses historical data + seasonal patterns to optimize production; reduces carrying costs 15-20%

- Rationale: Improves distributor satisfaction, reduces working capital requirement

Technology Investment Prioritization (5-Year Roadmap):

- Year 1: Table stakes only (basic manufacturing, certifications, website) - ₹12.5 lakhs

- Year 2: QR authentication + distributor portal - ₹3-5 lakhs (high ROI, low investment)

- Year 3: Automated pleating + computer vision QC - ₹15-20 lakhs (cost reduction drives profitability)

- Year 4: Product innovation (antimicrobial, multi-layer) - ₹5-8 lakhs (premium positioning)

- Year 5: Predictive maintenance platform - ₹10-15 lakhs (new revenue stream)

30. How do we balance build versus buy decisions?

Build vs. Buy Decision Framework:

BUY (Outsource/License) When:

Criteria 1: Non-core, standardized technology with competitive supplier market

- Example: Raw materials (filter media, CRCA sheets, PU foam) - Suppliers offer better quality and economics than in-house production

- Decision: BUY from Ahlstrom-Munksjö, Tata Steel distributors, chemical suppliers

Criteria 2: Capital-intensive with long payback at our scale

- Example: Filter media production (requires ₹2-5 crore facility for economic scale)

- Decision: BUY from specialized suppliers; revisit if we reach 500,000+ unit annual volume

Criteria 3: Rapidly evolving technology where we lack expertise

- Example: E-commerce platform (Amazon, Flipkart) - Building proprietary platform requires ₹50 lakh+ and 12-18 months

- Decision: BUY (use existing marketplaces); build proprietary D2C website only for brand control

Criteria 4: Compliance/certification where third-party credibility essential

- Example: ISO 9001, TS 16949 certification - In-house certification has zero credibility

- Decision: BUY from accredited certification bodies (₹3-5 lakhs)

BUILD (In-house Development) When:

Criteria 1: Core competency that defines competitive advantage

- Example: Filter pleating and assembly process optimization - Direct impact on product quality and cost

- Decision: BUILD in-house expertise through training and iterative improvement

Criteria 2: Proprietary knowledge that creates switching costs or network effects

- Example: QR-based authentication system + customer database - Creates data moat and customer lock-in

- Decision: BUILD with ₹2-3 lakh investment; sensitive data cannot be outsourced

Criteria 3: Long-term cost advantage outweighs upfront investment

- Example: Automated pleating machine - ₹15-20 lakh investment saves ₹8-10 lakh/year in labor; 2-year payback

- Decision: BUILD (purchase and customize) in Year 3 when volume justifies investment

Criteria 4: Speed to market critical and external suppliers too slow

- Example: New filter designs for emerging EV models - External design consultants take 6-9 months; in-house team can iterate in 4-6 weeks

- Decision: BUILD in-house R&D capability (1-2 engineers + testing equipment ≈ ₹8-12 lakhs annually) by Year 2

Hybrid Approach (Co-develop/Partner):

Partnership Model for:

- Advanced filter media development: Partner with material supplier for co-development; share costs and IP

- Automation equipment customization: Purchase standard pleating machine from Kanwal Enterprises, customize with in-house controls engineer

- Digital platform development: Use low-code platform (Zoho, Salesforce) for 70% of functionality, custom-build 30% that's differentiating

Specific Build-Buy Decisions:

| Technology Area | Decision | Rationale | Investment |

|---|---|---|---|

| Filter media production | BUY | Capital-intensive, suppliers offer better economics | ₹0 (purchase from suppliers) |

| Pleating machine (Year 1) | BUY standard | Volume too low to justify automation | ₹2 lakhs (manual/semi-auto) |

| Pleating machine (Year 3) | BUILD custom | Volume justifies automation, need customization | ₹15-20 lakhs (automated + custom controls) |

| Quality testing equipment | BUY standard | Industry-standard equipment available | ₹1.5 lakhs |

| QR authentication system | BUILD | Proprietary data asset, low cost | ₹2-3 lakhs (development) |

| E-commerce platform | BUY (marketplaces) | Established platforms offer reach | ₹0 (revenue share model) |

| ERP/inventory system | BUY (Zoho/Tally) | Standardized business processes | ₹1-2 lakhs/year (subscription) |

| Product innovation (multi-layer filters) | BUILD | Core differentiation | ₹5-8 lakhs (R&D + materials) |

| Distributor portal | BUILD (low-code) | Specific to business model | ₹3-5 lakhs (Zoho customization) |

| Predictive maintenance AI | PARTNER | Requires data science expertise | ₹8-12 lakhs (co-develop with tech partner) |

31. What's our intellectual property strategy?

IP Strategy: Trade Secrets > Trademarks > Patents

Rationale for Deprioritizing Patents:

- Filter designs are difficult to patent (prior art extensive, design variations easy)

- Patent enforcement in India is costly (₹10-30 lakhs litigation) and slow (3-5 years)

- Competitors can design around patents with minor modifications

- Patent filing costs ₹2-5 lakhs per patent; money better spent on market development

Primary IP Protection: Trade Secrets

Protected Elements:

- Manufacturing Process Optimizations: Exact pleating parameters, adhesive application techniques, quality control protocols - documented internally, access restricted to key personnel

- Supplier Relationships & Pricing: Raw material costs, payment terms, quality specifications - confidential agreements with suppliers, disclosed on need-to-know basis

- Customer Intelligence: Distributor performance data, pricing strategies, defect patterns - stored in password-protected systems, subject to employee NDAs

- Product Formulations: Specific blend of filter media layers, adhesive chemistry, gasket materials - reverse-engineering possible but time-consuming

Protection Mechanisms:

- Employment contracts with 2-year non-compete clauses for key technical staff

- Compartmentalized knowledge: No single employee has complete process knowledge

- Physical security: Restricted access to production floor for visitors

- Digital security: ERP access controls, regular audits

Secondary IP Protection: Trademarks

Registered Trademarks (Priority).

- Brand name and logo: Register under classes 7 (machinery parts) and 12 (vehicle parts); cost ₹8,000-₹15,000 per class

- Tagline/slogans: "Certified Clean Air" or similar positioning statement

- Product line names: Specific names for premium (e.g., "PureFlow"), standard (e.g., "DriveGuard"), economy lines

- Visual identity: Distinctive packaging color schemes (e.g., blue-silver for premium, red-white for standard)

Trademark Strategy:

- File applications within 6 months of launch (before market traction attracts copycats)

- Monitor marketplace for counterfeit use; send cease-and-desist letters proactively

- Budget ₹50,000-₹100,000 for initial trademark portfolio + ₹20,000/year maintenance

Tertiary IP Protection: Design Registrations

Registered Designs (Select Use):

- Distinctive filter canister shapes or pleating patterns that are visible to consumers

- Unique QR code integration method (e.g., embedded in product vs. sticker)

- Cost: ₹5,000-₹8,000 per design; 10-year protection

Strategic Value:

- Easier to enforce than patents (infringement is visual, obvious)

- Lower cost than patents

- Useful for premium product lines where aesthetics matter

IP NOT Pursued:

Utility Patents on Filter Designs:

- Rationale: Prior art is extensive; design-around is easy; enforcement is costly and slow

- Exception: If we develop truly novel filtration technology (e.g., nanofiber manufacturing process), file provisional patent to establish priority, then decide on full patent based on commercialization success

Open Innovation Approach (Collaborative IP):

Co-development Agreements with Suppliers:

- Partner with filter media suppliers on custom material development

- IP ownership: Supplier owns material IP, we own application IP; both can use but not license to competitors

- Example: Co-develop antimicrobial filter media with chemical supplier; they can sell media to others, we get 12-month exclusivity in automotive application

IP Enforcement Strategy:

Active Protection:

- Monitor IndiaMART, Amazon, Flipkart for counterfeit products using our brand/packaging

- Purchase suspect products, test quality, document deficiencies

- Send legal notices to sellers/platforms (cost: ₹10,000-₹20,000 per notice)

- Prioritize enforcement against distributors in our coverage area (protect primary revenue)

Passive Protection:

- Do not pursue small-scale infringers in geographies we don't serve (enforcement cost exceeds benefit)

- Use counterfeiting as market intelligence (indicates demand in new geographies)

Budget Allocation:

- Year 1: ₹100,000 (trademark filing, NDA templates, basic security measures)

- Year 2-5: ₹50,000/year (trademark maintenance, selective enforcement, employee training)

32. How do we future-proof against technological disruption?

Disruption Scenario Planning:

Threat 1: Electric Vehicle Transition Reduces Filter Demand

Scenario: EVs eliminate engine air intake filters; cabin filters become sole product line; market shrinks 40-50% by 2035

Adaptation Strategy:

- Product Pivot (Year 2-3): Develop EV-specific filter portfolio:

- Premium cabin air filters: HEPA + activated carbon + antimicrobial for health-conscious EV buyers (₹1,200-₹1,800 ASP, 50% margin)

- Battery thermal management filters: Cooling system particulate filtration for battery longevity

- Electronics enclosure filters: Protect power electronics from dust/moisture in harsh Indian conditions

- Market Expansion: EVs create new aftermarket opportunities (cabin filters replaced 2x/year vs. 1x/year for engine filters due to health focus)

- Implementation: Allocate 15-20% of R&D budget to EV products starting Year 2; build partnerships with EV OEMs (Tata Nexon EV, Ather, Ola Electric)

Threat 2: Extended Filter Lifespan Technologies

Scenario: Self-cleaning filters or advanced materials extend replacement cycle from 15,000 km to 40,000 km; aftermarket demand drops 60%

Adaptation Strategy:

- Technology Adoption, Not Resistance: License or co-develop extended-life filters; charge 2-2.5x price for 2.5x lifespan (net revenue per customer neutral or positive)

- Business Model Shift: From transactional to subscription/service:

- Filter-as-a-Service: Annual subscription for filter supply + installation + monitoring (₹1,500-₹2,000/year per vehicle for fleet customers)

- Predictive Replacement: IoT sensors monitor filter condition, trigger replacement only when needed (optimize customer costs while maintaining our revenue)

- Implementation: Begin pilot programs with fleet customers in Year 3; scale based on technology maturity

Threat 3: Direct OEM-to-Consumer Channels Disintermediate Distributors

Scenario: OEMs launch branded aftermarket platforms (e.g., "Maruti Genuine Parts Direct"); distributors lose relevance; our market access collapses

Adaptation Strategy:

- Build Direct Channels Preemptively:

- D2C E-commerce (Year 2-3): Develop own website + leverage Amazon/Flipkart for direct consumer sales (target 15-20% of revenue by Year 5)

- Service Center Partnerships: Direct contracts with independent multi-brand service chains (e.g., GoMechanic, MyTVS if expanding) for exclusive supply

- Corporate Fleet Direct: Bypass distributors for large fleet accounts (100+ vehicles)

- Make Distributors Indispensable: Invest in distributor technology (inventory management, demand forecasting) so they add value beyond product aggregation

- Implementation: Launch D2C website in Year 2 (₹3-5 lakhs investment); shift 5% of marketing budget to consumer-facing content

Threat 4: AI-Driven Counterfeit Manufacturing

Scenario: Generative AI enables rapid reverse-engineering; counterfeiters produce near-identical products at 40-50% lower cost due to no R&D/certification costs

Adaptation Strategy:

- Authentication Technology Arms Race:

- Blockchain-verified QR codes: Immutable production records, impossible to counterfeit digitally (₹5-8 lakhs investment)

- Covert security features: UV-reactive inks, microprinting, holographic labels (add ₹5-₹10 per unit cost)

- Brand Equity Over Product: Focus marketing on trust, warranty, service rather than just product features (counterfeits can copy product, not ecosystem)

- Legal Enforcement: Partner with industry associations for collective anti-counterfeiting enforcement (share costs with other manufacturers)

- Implementation: Implement blockchain authentication by Year 3; continuous investment in security features

Threat 5: Hydrogen/Alternative Fuel Vehicles

Scenario: India adopts hydrogen fuel cell vehicles; different filtration requirements; our product line becomes obsolete

Adaptation Strategy:

- Technology Monitoring: Allocate 5-10% of R&D time to emerging fuel technologies; attend industry conferences; build relationships with research institutions

- Fast-Follower Strategy: Don't pioneer hydrogen filter development (too risky); wait for market signal (100,000+ hydrogen vehicles), then rapidly develop product line using existing manufacturing infrastructure

- Diversification: By Year 5, expand to adjacent filtration markets (industrial HVAC, home air purifiers) to reduce automotive dependency to 60-70% of revenue

- Implementation: Join SIAM (Society of Indian Automobile Manufacturers) for early technology insights; maintain manufacturing flexibility

Future-Proofing Investments (% of Annual Net Profit):

- Year 1-2: 10% to EV product development and D2C channel building

- Year 3-4: 15% to automation (reduces labor dependency, improves adaptability)

- Year 5+: 20% to adjacent markets and emerging technologies

Cultural Future-Proofing:

- Hire engineers with diverse backgrounds (mechanical, chemical, software) to enable cross-functional innovation

- Establish "Innovation Time" policy: 10% of work hours for exploring new technologies/markets

- Partner with automotive engineering colleges for internship programs (talent pipeline + technology scouting)

Phase 4: Financial Engineering & Resource Planning

Funding Strategy

33. How much capital do we need for each growth phase?

Capital Requirements by Growth Stage:

Phase 1: Foundation (Months 0-12) - ₹21.78 Lakhs Total

Fixed Capital (₹14.00 lakhs):

- Plant & Machinery: ₹12.50 lakhs (power press, pleating machine, lathe, milling, drilling, welding, testing equipment)

- Furniture & Fixtures: ₹0.50 lakhs (office furniture, storage racks, workbenches)

- Other Miscellaneous Assets: ₹1.00 lakh (tools, jigs, fixtures, safety equipment)

Working Capital (₹7.78 lakhs):

- Raw materials inventory: ₹3.50 lakhs (30-45 days stock: CRCA sheets, filter media, PU foam, fasteners)

- Work-in-progress: ₹1.00 lakh (15-day production cycle inventory)

- Finished goods inventory: ₹1.50 lakhs (30-day stock for distributors)

- Receivables: ₹1.28 lakhs (45-day average collection period)

- Cash buffer: ₹0.50 lakh (operating expenses buffer)

Funding Mix:

- Own Contribution: ₹2.18 lakhs (10%) - Promoter funds

- PMEGP Subsidy: ₹7.62 lakhs (35% for rural/special category areas)

- Term Loan: ₹12.60 lakhs (58%) - 8-10% interest, 7-year tenor, 1-year moratorium

- Working Capital Loan: ₹7.00 lakhs (₹7.78 lakhs requirement, ₹0.78 lakh from operations) - 10-12% interest, renewable annually

Phase 2: Market Validation (Year 2) - ₹8-12 Lakhs Additional

Growth Investments:

- Expanded working capital: ₹4-5 lakhs (support 45% → 60% capacity utilization; increased inventory and receivables)

- Quality certifications: ₹2-3 lakhs (ISO 9001, TS 16949 certification processes, audits, documentation)

- Marketing & brand building: ₹1-2 lakhs (packaging design, promotional materials, distributor samples, trade show participation)

- Digital infrastructure: ₹1-2 lakhs (website development, QR authentication system, Zoho CRM/ERP)

Funding Mix:

- Retained earnings: ₹4-5 lakhs (Year 1 net profit ≈ ₹4.84 lakhs, reinvest fully)

- Working capital line increase: ₹2-3 lakhs (based on revenue growth and track record)

- Equipment financing: ₹2-3 lakhs (if adding capacity-specific machinery)

Phase 3: Scale-Up (Year 3) - ₹18-25 Lakhs Additional

Growth Investments:

- Automation: ₹15-20 lakhs (automated pleating machine with CNC controls, computer vision quality inspection)

- Working capital expansion: ₹8-10 lakhs (support 60% → 75% capacity; multi-state distribution requires higher inventory)

- New product development: ₹3-5 lakhs (EV-specific filters, antimicrobial cabin filters, R&D equipment)

- Marketing scale-up: ₹2-3 lakhs (regional advertising, mechanic training programs, brand ambassador)

Funding Mix:

- Retained earnings: ₹8-10 lakhs (Year 2-3 cumulative profits ≈ ₹15-18 lakhs, partial reinvestment)

- Equipment financing/leasing: ₹12-15 lakhs (for automation equipment, 3-5 year tenor, equipment as collateral)

- Working capital line increase: ₹5-6 lakhs (based on demonstrated revenue growth and DSCR >2.0)

Phase 4: Market Leadership (Years 4-5) - ₹25-40 Lakhs Additional

Growth Investments:

- Capacity expansion: ₹15-25 lakhs (additional production line, larger facility if needed, 2x capacity)

- Geographic expansion: ₹5-8 lakhs (working capital for new regional distribution networks, C&F agent deposits)

- Technology platform: ₹3-5 lakhs (predictive maintenance platform, advanced analytics, mobile app)

- Brand building: ₹5-7 lakhs (above-the-line marketing, influencer partnerships, consumer awareness campaigns)

- Adjacent markets: ₹3-5 lakhs (industrial/home filtration product development if diversifying)

Funding Mix:

- Retained earnings: ₹15-20 lakhs (Years 3-5 cumulative profits ≈ ₹30-40 lakhs, partial reinvestment)

- Growth capital (equity/quasi-equity): ₹10-15 lakhs (angel investors, SIDBI venture debt, state govt. schemes) for 10-15% stake

- Revenue-based financing: ₹5-10 lakhs (emerging option for profitable businesses, repayment tied to revenue %, no equity dilution)

Cumulative Capital Deployment (5 Years):

- Total: ₹75-100 lakhs

- External funding: ₹35-50 lakhs (debt/equity)

- Internal generation: ₹40-50 lakhs (retained earnings)

- Demonstrates self-funding capability by Year 3-4 (profitability funds growth)

34. What's the optimal mix of debt, equity, and operational funding?

Optimal Capital Structure Analysis:

Phase 1 (Years 0-2): Debt-Heavy Structure (90% Debt, 10% Equity)

Rationale:

- PMEGP scheme offers highly subsidized debt (8-10% interest + 35% subsidy); lowest cost of capital available

- Founders retain 100% ownership; no dilution at uncertain valuation

- Manufacturing business has predictable cash flows supporting debt servicing (DSCR 3.09 in Year 1)

- Tax shield benefit: Interest expense reduces taxable income

Structure:

- Equity (Promoter): ₹2.18 lakhs (10%)

- Subsidized Term Loan: ₹12.60 lakhs (58%, 7-year tenor)

- Working Capital Loan: ₹7.00 lakhs (32%, annual renewal)

- Effective PMEGP Subsidy: ₹7.62 lakhs (reduces net cash outflow)

Risks:

- High financial leverage (Debt/Equity = 9:1); vulnerable to revenue shortfalls in Year 1

- Working capital loan renewal risk if banks tighten lending

Mitigation:

- Maintain DSCR > 2.5 (actual projection: 3.09 in Year 1, improving to 4.65 by Year 5)

- Build cash buffer (3 months operating expenses) by Month 6 from operations

- Diversify banking relationships (2-3 banks) to reduce renewal risk

Phase 2 (Years 3-4): Balanced Structure (60% Debt, 40% Equity/Retained Earnings)

Rationale:

- Cumulative retained earnings ₹15-25 lakhs by Year 3 provide internal equity cushion

- Proven business model and track record enable negotiation of better debt terms (lower interest, longer tenor)

- Reduced financial risk as business matures and revenue stabilizes

Structure:

- Accumulated Equity: ₹2.18 lakhs (promoter) + ₹15-25 lakhs (retained earnings) = ₹17-27 lakhs (40% of total capital)

- Outstanding Term Loan: ₹6-8 lakhs (original loan amortizing)

- Working Capital Loan: ₹10-12 lakhs (increased limit based on revenue growth)

- Equipment Financing: ₹12-15 lakhs (for automation)

- Total Debt: ₹28-35 lakhs (60%)

Benefits:

- Debt/Equity improves to 1.5:1 (healthy for manufacturing business)

- No external equity dilution; founders retain 100% ownership

- Access to larger debt facilities based on strong financials

Phase 3 (Years 5+): Growth Equity Infusion (50% Debt, 35% Internal Equity, 15% External Equity)

Rationale:

- Growth capital needed for geographic expansion, adjacent markets, technology platform exceeds internal generation capability (₹40-60 lakhs required)

- Debt capacity constrained by banking norms (Total Debt/EBITDA < 3.0x)

- Strategic investors bring non-financial value: distribution networks, OEM relationships, technology expertise

Structure:

- Accumulated Internal Equity: ₹35-50 lakhs (promoter + retained earnings) - 60% ownership

- External Equity: ₹10-15 lakhs (angel investors, HNIs, SIDBI schemes) - 10-15% ownership

- Outstanding Debt: ₹30-40 lakhs (term loans + working capital + equipment financing)

- Total Capital: ₹75-105 lakhs

External Equity Sources:

- Angel Investors: Industry veterans (auto component executives) providing mentorship + capital at ₹80-120 lakhs pre-money valuation (10-12% stake for ₹10-12 lakhs)

- SIDBI Venture Debt: Quasi-equity instrument (12-15% return, 5-7 year tenor, revenue-linked warrants) for ₹8-12 lakhs

- State SME Funds: Some states offer equity/soft loans for manufacturing; explore eligibility

Dilution Protection:

- Retain >60% founder ownership post-dilution

- Negotiate board seat for strategic investors (not financial control)

- Right of first refusal (ROFR) on future equity raises to maintain ownership %

Operational Funding (Cash Flow Management):

Working Capital Optimization:

- Inventory Management: Reduce raw material inventory from 45 days to 30 days by Year 3 (frees up ₹1.5-2 lakhs); implement just-in-time purchasing with reliable suppliers

- Receivables Acceleration: Negotiate early payment discounts with distributors (2% discount for 15-day payment vs. 45-day credit); improves cash conversion cycle

- Payables Extension: Negotiate 60-day payment terms with suppliers (vs. 30-day); non-dilutive working capital financing

- Net Working Capital Reduction: From 90 days to 60 days by Year 3, freeing up ₹4-6 lakhs for growth

Alternative Financing Instruments:

- Invoice Discounting/Factoring: Sell receivables to factors at 1-2% discount for immediate cash; useful for large OEM orders with 90-120 day payment terms

- Channel Financing: Distributor floor planning - financiers fund distributor inventory purchases, we receive immediate payment, distributors repay over 60-90 days

- Equipment Leasing: Lease automation equipment vs. purchase (₹3-4 lakhs/year vs. ₹15-20 lakhs upfront); preserves cash for working capital

Optimal Mix Recommendation:

- Years 1-2: 90% Debt (subsidized), 10% Equity (maximize leverage with govt support)

- Years 3-4: 60% Debt, 40% Internal Equity (de-risk, self-sustaining)

- Years 5+: 50% Debt, 35% Internal Equity, 15% External Equity (fuel growth, bring strategic partners)

35. Which investors align with our vision and growth trajectory?

Investor Segmentation & Fit Analysis:

Stage 1 (Years 0-2): Not Investor-Ready - Focus on Debt & Government Funding

Rationale:

- Pre-revenue or early revenue stage; high execution risk

- Equity valuations would be unfavorable (₹20-40 lakhs pre-money); severe dilution for small capital amounts

- PMEGP and banking debt offer better economics (₹19.60 lakhs at 8-10% interest + 35% subsidy vs. 40-60% equity dilution)

Funding Sources:

- PMEGP/KVIC: Government subsidy scheme; aligned with employment generation objective; no dilution

- Priority Sector Lending Banks: PSU banks (SBI, Bank of Baroda, PNB) have mandates to lend to MSMEs; aligned with collateral-light lending

- Friends & Family: If ₹2.18 lakh promoter contribution unavailable; keep as informal loan, not equity

Stage 2 (Years 3-4): Angel Investors with Auto Industry Expertise

Ideal Investor Profile:

- Retired executives from auto component companies (Bosch, MANN+HUMMEL, Motherson, Amara Raja)

- 20-30 years industry experience; deep OEM relationships and supply chain knowledge

- Investment size: ₹8-15 lakhs for 10-15% stake (post-money valuation ₹80-120 lakhs)

- Not primarily financial return-driven; seeking entrepreneurial engagement and industry involvement

Value Beyond Capital:

- OEM Introductions: Warm introductions to procurement heads at Tata Motors, Mahindra, Force Motors for trial contracts

- Technical Mentorship: Guidance on quality processes, certification navigation, product development

- Distributor Networks: Connections to established auto parts distributors and C&F agents

- Credibility Signal: Angel's background validates quality and management capability to customers and banks

Alignment Factors:

- Vision fit: Excited by "Make in India" opportunity, solving import dependency, domestic manufacturing revival

- Exit expectations: 3-5 year horizon, 5-10x return acceptable (not expecting unicorn valuations)

- Involvement: Willing to provide 4-8 hours/month advisory time; possibly board observer role

Sourcing Strategy:

- LinkedIn outreach: Target auto industry leaders in Pune, Chennai, Delhi NCR with personalized messages

- Industry associations: ACMA (Automotive Component Manufacturers Association) events and networking

- Angel networks: Indian Angel Network (IAN), Mumbai Angels, Chennai Angels - focus on "Automotive" sector tags

- Alumni networks: IIT/NIT alumni angel groups; leverage educational connections

Stage 3 (Years 5+): Strategic Investors / Family Offices with Growth Capital

Ideal Investor Profile:

- Family offices of auto component distributors or aftermarket players seeking vertical integration

- Strategic corporates (tier-1 auto component companies) exploring filter segment entry via acquisition

- SIDBI/NABARD venture funds focused on manufacturing and SME growth

- Investment size: ₹25-50 lakhs for 15-20% stake (post-money valuation ₹150-250 crores)

Value Beyond Capital:

- Distribution Access: Family office-owned distribution networks provide instant market reach to 5-10 additional states

- Consolidation Play: Strategic corporate acquirer provides access to OEM contracts and export markets

- Operational Expertise: Growth equity funds bring professionalization (CFO support, process improvement, governance)

Alignment Factors:

- Vision fit: See automotive filtration as essential to auto ecosystem; believe in organized sector growth

- Exit expectations: 5-8 year horizon, IPO or strategic acquisition as exit (20-30% IRR target)

- Involvement: Board seat, quarterly reviews, financial oversight; less operational involvement than angels

Sourcing Strategy:

- Investment bankers: Engage boutique M&A advisors specializing in auto components (Avendus, o3 Capital)

- Industry conferences: ACMA Summit, Auto Expo, supplier meets - showcase growth story

- Government VC funds: Apply to SIDBI SME funds, state industrial development corporations

Investors to AVOID:

Misaligned Investor Profiles:

- High-growth-obsessed VCs: Expecting 50-100x returns in 5-7 years; incompatible with steady 4.3% market growth; will pressure for unsustainable expansion

- Passive financial investors: Seeking only financial returns without operational value-add; commodity capital not helpful at early stage

- Competitors: Direct competitors (Anand Filters, Fleetguard) would gain intelligence; create conflicts of interest

- Investors requiring quarterly revenue growth: Manufacturing has seasonal fluctuations; quarterly pressure creates short-term decisions

36. How do we maintain founder control while scaling?

Control Preservation Strategies:

Strategy 1: Minimize Equity Dilution Through Disciplined Capital Efficiency

Capital Efficiency Levers:

- Maximize Government Grants: PMEGP subsidy (35%) + subsidized loans reduce equity need by ₹20+ lakhs in Year 1

- Profit Reinvestment: Target 60-70% earnings retention (vs. 30-40% dividend payout) to fund growth internally; reduces external capital rounds

- Asset-Light Scaling: Outsource non-core activities (casting, logistics) rather than vertical integration; reduces capex needs

- Revenue-Based Financing: Explore non-dilutive growth capital (invoice factoring, equipment leasing, revenue-based loans) before equity

Dilution Milestones:

- Year 0-2: 100% founder ownership (no external equity)

- Year 3-4: 85-90% founder ownership (10-15% to strategic angels)

- Year 5+: 65-75% founder ownership (25-35% to growth investors cumulative)

- Always maintain >50% voting control through dual-class shares or shareholder agreements if necessary